Designer Gráfico/ UX-UI / Apresentações

SENIOR PARTNER

Carlos Rebelo Gloger

RGAA and Hospitality

Since 2018 RGAA started a division specialized in hospitality.

Our services vary from helping companies to do business in Brazil and South America, understanding the local culture, the local laws and business environment.

Among all of our services, we can offer:

-

Incorporation of a local legal entity

-

Advising on local laws and regulations

-

Support in finding local agents and distributors

-

Local support for the connection of the companies with the final client

-

Support clients to have their software adapted to the local rules and regulation

-

Support compliance with GDPR and the local Privacy Laws

-

Tailor made solutions for specific projects

We have already performed our services to several international companies with successful cases that could certainly be shared.

Hospitality Business in Brazil

The Brazilian hotel sector is recovering, showing significant improvements in occupancy rates and average daily rates in 2022. After being heavily impacted by the COVID-19 pandemic, the sector shows resilience and consistent evidence of recovery.

The recovery of international tourism in Brazil has been strengthening since 2022, as evidenced by the numbers of foreign arrivals, spending in the country, and international air connectivity.

The occupancy rate in 2021 stood at 43%, a 62.4% increase compared to 2020. The expectation is that the occupancy rate will return to historical levels in 2023.

As indicated in the InFOHB edition, the hotel occupancy rate in the country has increased 74.3% in the first 8 months of 2022, compared to the same period in 2021.

These results follow the growth trend expected earlier in the same year. We can highlight Brazilian South and Southeast regions, with particularly significant results, reaching occupancy rates of 85% and 78%, respectively. These data clearly illustrate the remarkable progress of the Brazilian hospitality industry during the mentioned period.

Occupancy rates in lodging beds has been growing every month in Brazil, surpassing even the numbers of 2019. This is creating an optimistic scenario among entrepreneurs in the hotel industry.

The recovery of international tourism in Brazil is being consolidated since 2022, as demonstrated by the numbers of foreign arrivals, spending in the country, and international connectivity. In January/2023, over 868,000 arrivals were recorded. This number surpasses the number of January/2019 by over 100,000 (before the pandemic) and represents a triple increase compared to the same period in 2022.

New hotel developments

The construction of new hotels in Brazil reflects a promising scenario for the sector. According to the 16th edition of the "Panorama of Brazilian Hospitality 2022" study, run by HotelInvest in partnership with the Forum of Hotel Operators in Brazil (FOHB), there are 124 hotels being built in 93 Brazilian cities, totaling over 18,000 new rooms. Among these, 38% are in an advanced stage of construction, and 62% are in the early development phase. This will represent an investment in the sector of R$ 5.3 billion by 2026.

.png)

Corporate destinations are expected to perform better than in 2022

Sanitary restrictions were relaxed during 2022, which stimulated the return of corporate demand and events. For 2023, it is expected an increase in occupancy in destinations that depend on these sectors, besides an increase of the average daily rate. On the other hand, Brazilian destinations for leisure/vacations may face a negative variation in occupancy, as international borders are open, allowing part of the demand to choose to travel abroad.

A 68.8% growth in RevPAR* driven by an increase in average daily rates in the second semester.

Performance evolution in Brazil** (values updated for January 2023)

*RevPAR means Revenue Per Available Room.

**Calculation based on the performance of 449 hotels (totaling 70,595 rooms) in 138 cities and 20 Brazilian states.

Why invest in Brazil

Several factors can be pointed to have Brazil as a very favorable country for receiving investments. Rare and abundant natural resources, favorable and extensive territorial area (8.52 million km2) – with great maritime and border access with 10 other countries – as well infrastructure steady growth – such as airports, highways, railways and ports.

Furthermore, the country has a population of nearly 214 million people according to the 2021 Census. Brazil was the largest economy in Latin America in 2021, being one of the 15 largest economies in the world. Additionally, the country has the second-best evaluation of economic climate in the region.

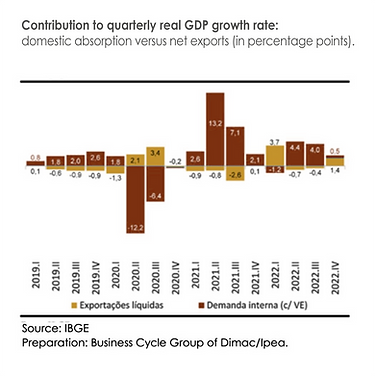

GDP Performance in the fourth quarter of 2022

Brazil's GDP experienced a decline of 0.2% in the last quarter of 2022 compared to the previous quarter, resulting in an accumulated growth of 2.9% throughout the year. Per capita GDP increased 2.2% compared to the previous year, reaching R$ 46,155.00.

The services sector was the biggest player to this growth, while household consumption had a significant influence on expenditures. Compared to the last quarter of 2019, before the pandemic, GDP is 4.1% higher. The decline in the last quarter of 2022 interrupted a streak of five consecutive quarters with positive variations, reflecting a slowdown in economic activity and possible restrictions in domestic demand due to contractionary monetary policy. The carry-over for 2023 stands at 0.2%, which means that, if there are no variations in the upcoming quarters, GDP will have a 0.2% increase by the end of the year.

In terms of investments, Brazil was the third-largest global destination for foreign direct investment (FDI) in 2022, according to the Organization for Economic Cooperation and Development (OECD), staying behind the United States and China. Foreign direct investment flows in Brazil recorded a significant increase of 68% in 2022, reaching USD 85 billion, which put Brazil in the position of the third largest FDI destination worldwide.

A very favorable exchange rate makes the local assets extremely cheap.

Local investments in the stock market are very attractive: low risk level public bonds pay around 10-12% annually. For moderate risks, returns can easily exceed 12%, with virtually no risk to the capital.

Rebelo Gloger Advogados Associados

2023 - Todos os direitos reservados

Curitiba-PR | +55 (41) 3024.0694

São Paulo-SP | +55 (11) 3185.6601

Itajaí-SC | +55 (47) 3517.0579